child tax credit november 2021 not received

2 days agoFamilies can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. Thats an increase from the regular child.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The deadline is 1159 pm Eastern Time on Monday November 15.

. The IRS allows you to update your tax information online. For 2021 eligible parents or guardians. That means the October November and December payments for affected parents will be reduced by 10-to-13 per child.

He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. 15 2022 at 1214 pm. IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

If you did not receive advance payments of the child tax credit in 2021 you can receive the full 3600 credit if you qualify when you file your tax return. To do so quickly and securely visit IRSgovchildtaxcredit2021. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. The total credit is as much as 3600 per child. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in March.

The deadline for this money is also fast approaching people who qualify have to file their information by. 2 days agoThe IRS wants you to get your stimulus check and child tax credit cash if you havent claimed it heres what to look for Last Updated. About half of that was given in monthly.

A childs age determines the amount. However a child born or added to your family such as through adoption in 2021 can be a qualifying child for the full 2021 Child Tax Credit even if you did not receive monthly Child Tax. 7 hours agoThe program provided parents with a child aged 6 or older a 3000 tax credit.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Right now they can only sign up online. Child Tax Credit.

1 day agoMore than 9 million people and families who did not receive their advance Child Tax Credit checks stimulus payments and other tax rebates must file a 2021 federal income tax. Affected parents should have received letters. Check the box for Individual as the Type of return Enter 2021 as the Tax Period Do not write anything for the Date Filed Write.

Can the parent of any. The payments were part of the American Rescue Plan with the first monthly advance child tax credits CTC payments. The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5.

The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency. Parents with a younger child received a 3600 check. 2 hours agoPrior to 2021 the Child Tax Credits maximum value was 2000 per child.

Starting with Tax Year 2022 eligible New Jersey residents can claim a refundable Child Tax Credit on their New Jersey Resident Income Tax. Last year that maximum value rose to 3600 for children under the age of 6 and 3000 for children aged. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. When completing item 7 under Section 1. On Thursday the IRS said it will send letters to more than 9 million families who are potentially eligible for benefits including stimulus payments or Child Tax Credits but didnt.

One Week Until November Child Tax Credits Are Paid Out What Time You Ll Get Them Explained The Us Sun

How The Advance Child Tax Credit Works And Who Can Claim The Credit Travis Raml Cpa Associates Llc

Gov Urges Eligible Ct Families To Apply For Child Tax Credit Before Nov 15 Deadline Nbc Connecticut

Child Tax Credit Payment Schedule For 2021 Kiplinger

Letter Advanced Child Tax Credit Payments Allow Some Taxpayers To Stay Unemployed

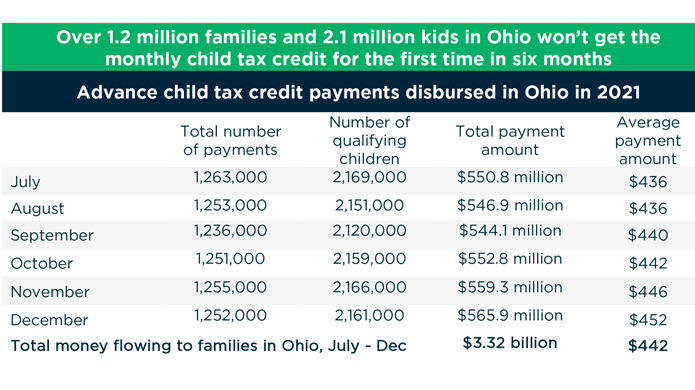

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Child Tax Credit 2021 What To Know About New Advance Payments

Child Tax Credits Should Promote Work Not Undermine It Child Tax Credits Should Promote Work Not Undermine It United States Joint Economic Committee

Child Tax Credit Delayed How To Track Your November Payment Marca

Where Is My Child Tax Credit Netspend

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Get A Child Tax Credit Act By November 15th And You Could Get Thousands Muskegonchannel Com

November Child Tax Credit Payment Went Out Signup Deadline Looms

The Child Tax Credit Toolkit The White House

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

2021 Child Tax Credit Advanced Payment Option Tas

Millions Of Eligible Families Did Not Receive Monthly Child Tax Credits While More Than 1 Million Ineligible Taxpayers Did Cnn Politics